I was surprised more fuss wasn’t made of Fitch’s October 2013 downgrade of Grupo ACP – the main shareholder of Peru’s flagship microfinance institution (MFI): MiBanco.

“The downgrade [] is driven by ACP’s losses (mainly due to foreign exchange volatility during 2Q13 in Peru and the region) and the weakness of its dividend revenues caused by the performance of its main operating subsidiary and revenue generator, Mibanco… Mibanco’s performance deteriorated in 1H2013, as credit costs (loan loss provisions) increased significantly and, along with lower operating revenues, drove profitability down to 0.74% (ROAA)…, recovery is not expected to be swift… At end 2Q13, ACP breached the indebtedness covenant of its 10- year, US$85 million corporate bond due on 2021.”

The article goes on to explain how Grupo ACP negotiated a waiver of its loan covenants until June 2014 – not long now. S&P subsequently issued a warning about the Peruvian microfinance market. Peruvian banks saw profits slow in 2013, profit at Edpymes (small private MFIs) fell by 13%, while the cajas saw profits plunge 90%.

MiBanco is one of the biggest MFIs on the planet and it doesn’t seem to be doing that well. Dividends and profitability are down; portfolio quality is deteriorating; its main shareholder, Grupo ACP, is breaching its covenants; and the rating outlook is negative. Sounds pretty serious to me.

MixMarket data confirms this. MiBanco’s return on assets (ROA) fell from 1.91% in 2011 to -0.10% a year later, while return on equity (ROE) fell from 20.47% to -0.89%. The more reliable COPEME reports support these results.

Furthermore, the ominous warning about deteriorating portfolio quality is confirmed by the available data. In November 2012 MiBanco had a reported overall PAR30 (proportion of outstanding loans delinquent over 30 days) of 7.3% – fairly high by international standards, particularly for a large commercial MFI, and compares unfavourably with other Peruvian MFIs. PAR30 reached 9.1% for loans specifically to small companies. The MixMarket reports an overall PAR30 of 8.14% by mid-2013, and over 12% in 2012 (while ACP claim it was only 4.5% on page 39 of their 2012 annual report).

From December 2012 to September 2013 MiBanco’s portfolio declined from $1.9 billion to $1.7 billion, while client numbers fell by nearly 100.000. Even more worryingly for such a large MFI, 61% of its clients have loans elsewhere (the second highest bracket in the COPEME report), hinting that over-indebtedness could be an issue in Peru. This is not the first time over-indebtedness concerns have been raised in Peru: see a June 2012 article; or a March 2013 Planet Finance report which summarised succinctly: “obvious – and high – degree of multiple borrowing in Peru”.

According to the Economist Peru is the best country in the world for microfinance, and MiBanco is the largest MFI in the country. But something is going wrong. This is interesting firstly because there are already murmurs in the sector that Peru could be about to face a serious crisis fuelled by chronic over-indebtedness. Secondly, MiBanco boasts an important set of investors, including Accion – a key global player in microfinance. In part for their profiteering performance regarding Banco Compartamos in Mexico, Accion inspire polarized opinions regarding the benefit, or curse, of commercial microfinance. It will be interesting to see how Accion’s pet project for sector-wide self-regulation, the inappropriately-named Smart Campaign, will respond to mounting evidence of a crisis in Peru. I imagine with utter silence, as their salaries depend to some extent on the profitability of their investments. They claim to be the self-regulator or watchdog of the sector, the fair trade label of microfinance. But Accion holds some uncomfortable investments.

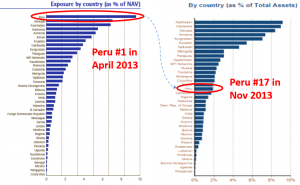

But perhaps even more intriguingly, according to the April 2013 Investor Update of Swiss investment fund BlueOrchard, their total microfinance portfolio was $270m, but by May it had fallen by $15m to $255m. What accounted for this dramatic decline of nearly 5% of the fund value in a single month? In the April report the single largest loan of the fund was to MiBanco, representing 6.47% of the entire fund (about $17.5m). Peru was the single largest recipient of funding with approximately 9.5% of the entire fund, i.e. BlueOrchard had other Peruvian investments of approximately 3% of the portfolio.

By May, Peru had fallen to 12th place and represented only 3% of the portfolio. In light of the downgrade it appears that BlueOrchard may have been fortuitous to get out of MiBanco when they could. They mention the departure of MiBanco explicitly, but without mentioning the MFIs performance:

“[T]he allocation to Peru decreased considerably as a result of the timely repayment of an outstanding loan to Mibanco. Changes in the Peruvian regulatory framework require a 36-month minimum duration for new loans to microfinance institutions that can currently or in the near future capture deposits (financieras and banks). This translates into a minimum life of 41 months, whereas the prospectus guidelines of the BlueOrchard Microfinance Fund limit the loan tenor to a maximum of 3 years. With an increasing number of institutions graduating to the status of financieras, this regulatory constraint will result in a reduced country allocation to Peru and further diversification within South and Central America.”

Did Blue Orchard re-lend this capital to other institutions, if not in Peru perhaps in South and Central America, as stated? It appears not – by August the portfolio had fallen a further $2m, to just under $253m. Meanwhile Peru fell to 17th place in BlueOrchard’s portfolio by November, just above Cameroon.

Is Blue Orchard’s justification for not rolling over the MiBanco loan valid? It could be a convenient excuse for getting out of an over-heated country without stating so explicitly. The new CEO is no fool, but nor will he wish to irritate the funding sector by pointing out what many already fear. It was either lucky or intelligent – well done either way.

Blue Orchard’s main rival, responsAbility, has a staggering $110m invested in the Peruvian financial sector (see page 13 of their 2012 annual review), including $6m to MiBanco – they must be sweating currently. And let’s not underestimate the size of the Peruvian microfinance sector – according to the MixMarket (the best data available, alas) Peru represents nearly one third of all lending in Latin America and the Caribbean. At $10.7bn, Peru is 12% of all microfinance lending on Earth ($90bn). It’s 25% more than Africa and the Middle East combined. South Asia, including the markets of India and Bangladesh, accounts for only $8.2 billion. To conclude that Peru is therefore over-saturated would require a more detailed analysis of populations and penetration levels, but in short – microfinance in Peru is big business. Only the microfinance sectors of Indonesia and China exceed that of Peru, but with populations of 240m and 1.4bn respectively, versus Peru’s rather modest 30 million. Mexico, Bolivia and Ecuador, all of which have faced concerns over over-indebtedness, have a combined population of nearly 150 million, and yet their combined microfinance sectors are smaller than Peru (approximately $10 billion). While such comparisons may not be entirely valid, it goes without saying that a collapse of Peru’s microfinance sector would have catastrophic implications for the entire microfinance sector.

To put this over-indebtedness into perspective, there are approximately 4 million microfinance clients in the Peruvian microfinance sector, of which a quarter are shared with other banks (i.e. double counting due to multiple lending, according to COPEME), for a total of approximately 3 million unique clients. The average client therefore has an outstanding microfinance loan of approximately $3,500, excluding store cards, mortgages etc. Interest rates are typically of the order of 35% per year, suggesting the average client is paying about $1,200 per year in interest alone. For a country with a GDP per capita of $6,500, it seems worrying that a fifth of this is directed merely to interest payments on loans.

According to the MixMarket the following are also “funders” of MiBanco: AECID (Spain); Bamboo Finance (spin-off from BlueOrchard, Switzerland); the IFC (multilateral); Incofin (Belgium); Triodos (Holland); and Profund (Costa Rica). In addition MiBanco posts its shareholders on its website:

- Grupo ACP hold 60.7%

- The IFC has 6.5%

- Accion has 15.69% (via the Cayman islands, of course)

- Triodos has 11.82%

- Other minor investors account for 5.92%

Those listed on the MixMarket but not on MiBanco’s website are either out of date (not the first time the Mix has deviated from reality); debt-only providers (e.g. responsAbility); or included within “other investors” (Bamboo Finance lists MiBanco as an investment on its website, so it is presumably one of the smaller investors).

The rating downgrade makes another ominous claim: “ACP’s management reports advanced negotiations to capitalize the group. However, if the capitalization is delayed or reduced, ACP would have limited cash flow to fulfill its financial commitments, hence the Negative Rating outlook”. Who would invest in ACP right now? Its international portfolio consists of marginal institutions, the only jewel in the crown is MiBanco, and recovery there is unlikely. A 21% reduction in return on equity in a single year combined with a breach of covenant is hardly attractive, and profits in 2013 halved. The larger microfinance funds such as responAbility or DWM could be interested, or even an existing investor such as Bamboo Finance. Beyond that, the mainstream private equity investors are unlikely to take such a gamble while the legal status of ACP is still unclear – it is currently an NGO. However, a vulture fund focussed on acquiring distressed assets could seek to buy MiBanco at a low price, strip it and get out quickly, helping Grupo ACP to limp on another day. But the redundancy costs involved would be huge.

Rumours have surfaced that Credicorp (main shareholder of Banco de Crédito de Perú – BCP) may be sniffing around MiBanco as a potential acquirer. Everything depends on price – Barings Bank was in dire trouble in 1995 and yet ING bought the bank for £1. To buy a clearly struggling, massive bank in a country that most sane insiders suspect is significantly over-heated and enjoys rampant over-indebtedness is a bold move. But, as decades of microfinance history has shown, the sector is littered with fools willing to ignore facts and take reckless gambles for the sake of a quick buck at the expense of the poor. The management of Credicorp will no doubt get a bonus for pulling of an acquisition, and do we really believe they will put the long term interests of the Peruvian poor above a nice bonus and a quick buck for their shareholders? Perhaps Credicorp’s board may wise up to this. I hope so, as this could be an expensive mistake. They are in safe hands, however – the advisors to the transaction are none other than those of Banco Compartamos, so they are familiar with vulture capital(ists).

As if evidence of strife at ACP was not yet clear, on February 4th this year (i.e. this week), they flogged a 12% stake in Bolivia’s BancoSol to prop up their balance sheet. Desperate times call for desperate measures.

But let ’s not exclude the broader situation in Peru. Economic growth is forecast to slow in 2014, while inflation is rising. Investors are broadly pulling out of developing countries. Civil unrest aimed against the some of the large mines has already caused riots, eerily reminiscent of the Nicaraguan “no pago” crisis. Mining revenues are declining, as is tax income. With growing over-indebtedness it is not inconceivable that more militant factions of this somewhat socialist country could trigger a similar meltdown. The images above are from a recent uprising in Peru, and the Nicaragua “no-pago” crisis. Can you spot which is which? With so many deposit-taking institutions, a run on the banks is possible were Peruvians to begin questioning the safety of their deposits.

’s not exclude the broader situation in Peru. Economic growth is forecast to slow in 2014, while inflation is rising. Investors are broadly pulling out of developing countries. Civil unrest aimed against the some of the large mines has already caused riots, eerily reminiscent of the Nicaraguan “no pago” crisis. Mining revenues are declining, as is tax income. With growing over-indebtedness it is not inconceivable that more militant factions of this somewhat socialist country could trigger a similar meltdown. The images above are from a recent uprising in Peru, and the Nicaragua “no-pago” crisis. Can you spot which is which? With so many deposit-taking institutions, a run on the banks is possible were Peruvians to begin questioning the safety of their deposits.

A final observation is that people in the sector have been very unwilling to discuss this. For the magnitude of the implications it received remarkably little attention. microDINERO was the only news agency to translate the Fitch downgrade report to Spanish. Even Peru’s leading financial newspaper, Gestion, failed to mention it.

However, there is no way the sector would allow a collapse of either an MFI of this size, or of the Peruvian microfinance sector more broadly. They are simply “too big to fail”. The implications of a Peruvian collapse would be catastrophic, and almost every microfinance fund would lose significant sums, if not collapse entirely. No, this has to be bailed out, and if not by BCP or a vulture fund, then a state-funded bail-out, or some soft-financing from the IFC or some such body would be required. The sector is groaning after five years of criticism and scandal, this could be the hair that breaks the camel’s back. Even if the neo-liberals have to dig deep into their own pockets they are not yet ready to throw in the towel on their beloved scheme to indebt poor people. Peru may be their current, and perhaps greatest challenge to date.

So, what can we conclude from this brief analysis? I would suggest the following:

- Regardless of what the Economist says, I wouldn’t invest a dime in Peruvian microfinance right now. Over-indebtedness is mounting, the pre-cursor to previous crises; the flagship MFI is in trouble; and the first investors are withdrawing.

- This will be the acid-test for the Peruvian regulator, whom the Economist praises so lavishly. Can it avert a crisis without over-regulating the sector? We are about to find out, but let’s not forget that India was thus praised prior to the Andhra Pradesh crisis, as was its leading MFI – SKS – prior to the 90% collapse in its share price. Pride comes before a fall. And whose interests will be protected – those of investors, or the poor?

- MiBanco is likely to re-focus its portfolio in the sectors where it performs best:

- Housing loans earn a small gross margin and are a relatively minor share of the portfolio, so unlikely to be the source of the turnaround.

- Consumption loans have healthy returns but are also a relatively small share of the portfolio.

- Microfinance loans are their core market, have reasonable returns, and MiBanco maintains an acceptable risk level in this segment (PAR30 of 4.7% for microloans according to COPEME).

- … But this does not necessarily bode well for other Peruvian MFIs. If MiBanco re-focuses on microfinance and consumption loans (often interchangeable), this will further direct funding to these already over-indebted niches.

- Fitch’s downgrade was strongly worded, with a negative outlook, and explicitly states that improvement is far from imminent – there has been none to date.

- Blue Orchard were wise to get out when they did – a fund attempting to avoid any scandals or collapses following the mass exodus of its own investors over the last couple of years. Once bitten twice shy – they were bitten in Nicaragua and presumably don’t want a repeat.

- Triodos are likely rather nervous and watching the Peruvian market closely, but as equity investors there is little they can do other than ride it out. However, they may be sitting on a sufficiently large capital gain that a fire sale exit may be under consideration. I generally like Triodos, and blogged about them previously. MiBanco was always an outlier within their portfolio.

- Accion – they’re sitting on such a pile of cash from their investment in Compartamos that I can’t feel too worried for them. If anything disastrous does occur in the Peruvian microfinance sector it might make the Smart Campaign look even more ridiculous than it already does, but does anyone take Smart seriously anyway? As one commentator suggested wittily, “The SMART Campaign is actually misnamed—CRAFTY would be more appropriate.” Preventing over-indebtedness is apparently one of their key goals, and at least two of Accion’s investments are major contributors to the problem.

- I am keeping my eyes peeled for any signs of civil unrest, animosity towards banks, bank activities that could be viewed as aggressive (confiscating assets etc.) which typically spark (not cause) a national revolt, as happened suddenly and violently in Nicaragua and India.

- If fair-weather investors discreetly start to reduce exposure to Peru, or there are signs of Peruvians withdrawing savings as they fear for the integrity of some institutions, this may accelerate such a collapse.

- Keep your eyes open for soft funding to prop up either ACP/MiBanco or an acquirer. If BCP/Credicorp pulls out of the acquisition, hold your breath.

Microfinance crises are obvious with hindsight, but difficult to predict as their causes are often hidden by the MFIs and their investors, and begin with a small spark. See Nicaragua or Andhra Pradesh if in doubt. The first warning signs are generally ignored. Is this a Peruvian red flag? I don’t know, but it certainly makes me nervous.